Little Known Questions About Financial.

Wiki Article

Some Known Factual Statements About Roth Iras

Table of ContentsUnknown Facts About Financial

Financial advisor's pay can be based upon a cost, compensation, profit-percentage structure, or a combination thereof. "Financial advisor" is a generic term with no accurate industry interpretation. Therefore, this title can describe many different kinds of economic experts. Stockbrokers, insurance coverage representatives, tax obligation preparers, financial investment supervisors, as well as financial organizers can all be considered financial consultants. Still, a vital distinction can be made: that is, a financial consultant has to actually supply support and also advice. An economic advisor can be distinguished from an execution stockbroker that simply positions professions for clients or a tax obligation accounting professional who simply prepares income tax return without providing advice on exactly how to maximize tax obligation benefits . A true financial consultant should be a well-read, credentialed, experienced, economic professional that works with part of their customers, as opposed to serving the rate of interests of a financial establishment by maximizing the sales of specific items or maximizing payments from sales. There were 330,300 expert economic advisors in the united state Nonetheless, their compensation structure is such that they are bound by the agreements of the business where they work.

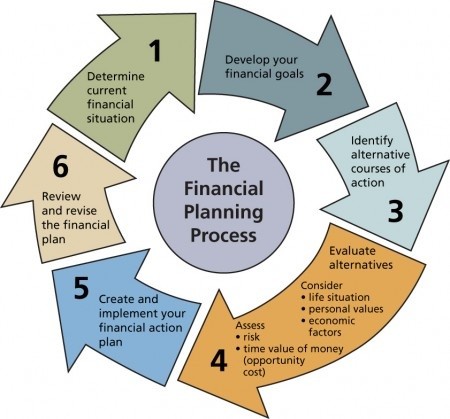

Considering that the enactment of the Financial investment Consultant Act of 1940, two sorts of relationships have actually existed in between monetary intermediaries and their clients. These are the reasonableness requirement and the more stringent fiduciary requirement. There is a fiduciary partnership that requires advisors signed up with the Securities as well as Exchange Payment(SEC)as Registered InvestmentAdvisors to exercise responsibilities of loyalty, care, and also complete disclosure in their interactions with customers. While the former is based upon the concept of "caution emptor"led by self-governed rules of"viability "as well as"reasonableness"in suggesting an investment item or strategy, the last is based in federal laws that enforce the greatest ethical criteria. The monetary organizer is one specific sort of monetary advisor that specializes in assisting business and individuals develop Full Article a program to meet long-term monetary objectives. A financial coordinator might have a specialty in financial investments, taxes, retirement, and/or estate planning. Further, the financial coordinator might hold numerous licenses or classifications, such as the Certified Monetary Organizer(CFP)classification. To end up being a monetary advisor, one very first needs to complete a bachelor's degree. A level in financing or business economics is not needed, however this does assist. From there, you would certainly look to be employed by a banks, frequently joining through a teaching fellowship. It is recommended to operate at an organization as it will sponsor you for the industry licenses you need to finish before sites being able to practice as an economic advisor. A teaching fellowship or entry-level work will also aid you comprehend the industry and also what is needed for the job. Planner. The licenses you will need to finish may include Collection 7, Collection 63, Collection 65, and Series 6. When you get the licenses, you can work as an economic consultant. Financial consultants are charged with taking care of every aspect of your monetary life, from retired life preparation to estate preparation to cost savings and investing. They examine your financial standing and comprehend your financial goals and create a tailored financial plan to accomplish those objectives. They can help in reducing the tax obligations you pay and maximizethe returns on any kind of monetary possessions you may have. The cost of an economic expert relies on the solutions you hire them for. There are also various costs for the different tasks that a monetary consultant will certainly carry out. Numerous financial advisors bill a flat annual fee between$ 2,000 and $7,500; between$1,000 and $3,000 for creating a tailored economic planand depending upon the agreement, compensations of 3%to digital financial advisor 6%on the account.

Report this wiki page